On August 10, 2017, The Gateway Program Development Corporation (GDC) published a request for information (RFI) regarding Phase 1B. The Gateway Program (GP) objetive is to increase the capacity and service level of the Northeast Corridor (NEC). The GDC is integrated by the National Passenger Railroad Corporation (Amtrak), the New Jersey Transit Corpoartion (NJ Transit) and the Port Authority of New York and New Jersey.

Source: RFI 2017-01.

Phase 1B of Gateway Program

The RFI is intended to gather inputs from the private sector in order to finance, develop and manage the 3 components of Phase 1B:

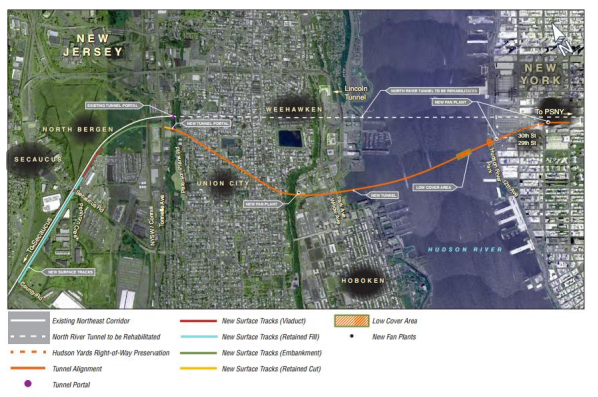

- New 2 track rail tunnel in the Hudson River

- Rehabilitation of the 106 year old North River Tunnel

- Completion of the Hudson Yards Concrete Casing

Private sector inputs to promote innovation

The GDC is asking private firms to propose on key project elements such as:

- Project delivery method: including a possible public private partnership (P3, PPP).

- Risk allocation between public and private participants.

- Funding (who pays) and finacing (who bears the financial risk).

- Best practices to reduce costs during the procurement process.

The Global Infrastructure Hub (GIH) recently published the Global Infrastructure Outlook which estimates the United States transportation infrastructure investment gap at US$3,709 billion (US$3.7 trillion) for the next 25 years. For the same period of time (2016-2040), the American Society of Civil Engineers (ASCE) projected a US$4,942 billion (US$4.9 trillion) investment gap. To put in perspective, infrastructure gap is higher the Germany´s gross domestic product (GDP). Thus, the GP RFI will be an interesting test on how PPPs could help the US to update its infrastructure system.